The start of 2020 brought much uncertainty, as in an effort to contain the COVID-19 pandemic, countries around the world shut their borders and imposed lockdown measures on their residents.

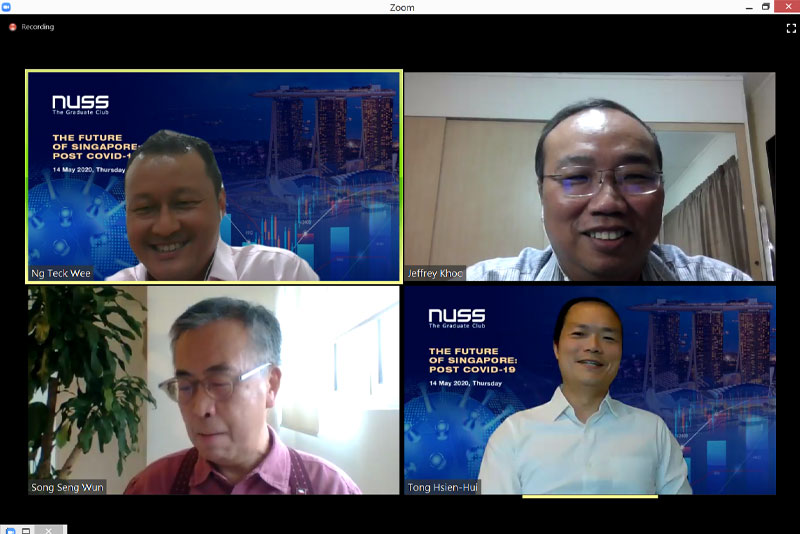

To learn how they can navigate this uncertainty, 230 members and guests joined “The Future of Singapore: Post COVID-19”, an online dialogue hosted by NUSS on 14 May 2020. Panellists Mr Song Seng Wun, an economist at CIMB Private Banking; Mr Tong Hsien-Hui, Head of Investments at SGInnovate; and Mr Jeffrey Khoo, Chief Marketing Officer at ED Broking Asia; shared their opinions on what we can expect when it comes to Singapore’s economy in the coming months.

Mr Tong kicked off the session with an overview of a possible scenario that could soon happen. He predicted that as it is unlikely that mass vaccination could occur within the next 12 months, so social distancing would continue to be the norm. This would result in the restructuring of processes for many workers, while professional and social activities would continue to be constrained within national borders. This, in turn, could adversely impact several industries and may lead those that find it hard to adapt to close.

At the same time, companies that are able to capture opportunities presented by this new environment will experience rapid growth. Mr Tong expects to see an increased role that technologies such as digital identity, cybersecurity, devices and communication networks, will play in how we work, as a result of social distancing. He added that the pandemic has created a greater need for countries to divert more resources into the development of industries such as medtech, fintech and edutech, among others.

Touching on the pandemic’s impact on the insurance sector, Mr Khoo felt that the industry has yet to experience the full economic impact of the pandemic, as claims by the insured have will likely come only in the third quarter of 2020. The insurance industry can also expect to see reduced demand in policy sales, as consumers choose to tighten their spending during this period, as well as an increase in claims from insurable events.

In the long-term, however, the sector may see increased demand for life and health insurance, as consumers may want to be better insured from events like a global pandemic.

As a result, insurance companies may look into changing in policy wordings, reviewing premium rates and conducting more stress tests to see if they would withstand another pandemic. Some may also move to digitalise their processes and improve consumer marketing strategies to focus on insuring against a pandemic.

On the impact on the greater economy, Mr Song said that this “Great Lockdown”, a term coined by the International Monetary Fund to refer to the current recession, will be the steepest in almost a century, and warned that there is “extreme uncertainty around the global growth forecast”. He felt that because Singapore’s economy is dependent on trade, the nation would likely feel the impact in the second quarter. Easing lockdown measures and reopening the country would take time, so the government and central banks will continue to take a “whatever it takes” approach to mitigate the effects of the economic crisis. However, while Singapore may experience a sharp downturn, Mr Song is hopeful that it would also make a quick rebound, as the government had for some time now prepared the nation for a recession.

The panellists received a steady stream of questions from participants during the Q&A session, which ranged from on insurance policy upgrades and forecast on various industry sectors.

When asked, Mr Tong responded that the aviation industry would face a long road to recovery, as it hinges on when countries around the world would lift travel restrictions. Meanwhile, sectors such as retail would be forced to relook their modus operandi and place more emphasis on serving their customers digitally. Technology and its applications would be the biggest winner moving forward. And both Mr Tong and Mr Khoo agreed that industries dealing in mental health would also likely see increased demand from the anxiety brought about by the pandemic.

On the possibility of the global economy bottoming out, Mr Song responded that countries’ performance over the next two quarters is key, and maintained that recovery would be slow. In this phase, nations such as the United States and Singapore have looked to their central banks to do the “heavy lifting”, while several governments have rolled out measures to aid businesses in retaining workers and tide them through this difficult period. But the panellists stressed that while Singapore’s government has offered strong support, the onus lies on individual businesses to find ways and means to preserve and build on their resources.

The session concluded with a poll that showed 92 per cent of participants found the dialogue useful and informative. If you missed this session, click here to watch.